The assumption that only one product is produced or that product mix will remain unchanged is difficult to find in practice. Selling price of a product depends upon certain factors like market demand and supply, competition etc., so it, too, hardly remains constant.ĥ. The assumption that selling price remains unchanged gives a straight revenue line which may not be true. In practice, they move, no doubt, in sympathy with volume of output, but not necessarily in direct proportions.Ĥ. It assumes that variable costs vary proportionately with the volume of output. It should be noted that fixed costs tend to vary beyond a certain level of activity.ģ. It assumes that fixed costs remain constant at all levels of activity. In practice, however, it may not be possible to achieve a clear-cut division of costs into fixed and variable types.Ģ. Break-even analysis is based on the assumption that all costs and expenses can be clearly separated into fixed and variable components. The contribution margin per unit can be calculated by deducting variable costs. Break Even Point in Units Fixed Costs/Contribution Margin. (viii) It reveals business strength and profit earning capacity of a concern without much difficulty and effort. The formula for break-even point (BEP) is very simple and calculation for the same is done by dividing the total fixed costs of production by the contribution margin per unit of product manufactured. The break-even analysis is based on certain assumptions.

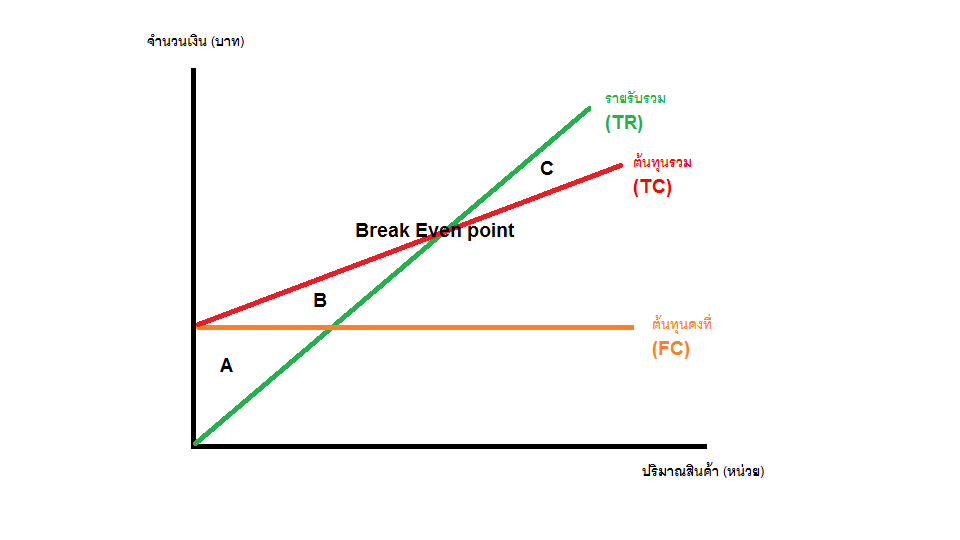

Break-even point has a wide use in the field of marginal costing and helps to decide the product mix, fixation of selling price, steps to be taken in long-term planning etc.īreak-even point can be ascertained by using the following formula:Īssumptions Underlying Break-Even Analysis: Loss results in the left side of P, i.e., before the break-even point is reached, and, beyond P, profit starts to generate. P is the break-even point in the break-even chart where OS and CT-being the sales line and total cost line-intersects. It can be concluded that at break-even point the contribution earned just covers the fixed cost and, at levels below the point, contribution earned is not sufficient to match the fixed cost and, at levels above the point, contribution earned more than recovers the fixed cost.

Or, Sales – Variable Cost = Contribution = Fixed Cost Thus, it is the minimum point of production where total costs are recovered.

0 kommentar(er)

0 kommentar(er)